If you put your planned detail in place and then measure your spending habits against that plan you will be able to determine how you can change your habits and save money. The goal of this tool is allow you to manage your cash over time using what actually occurs versus your plan. If desired, the Description grouping can be expanded to display the data summarized by day. The user can expand the Category grouping to display summary by Category and Description. In the Design tab, click Add fields, and then select BudgetPlanHeader as the entity data source. Click Design in the Data Connector to add header fields to the Excel file.

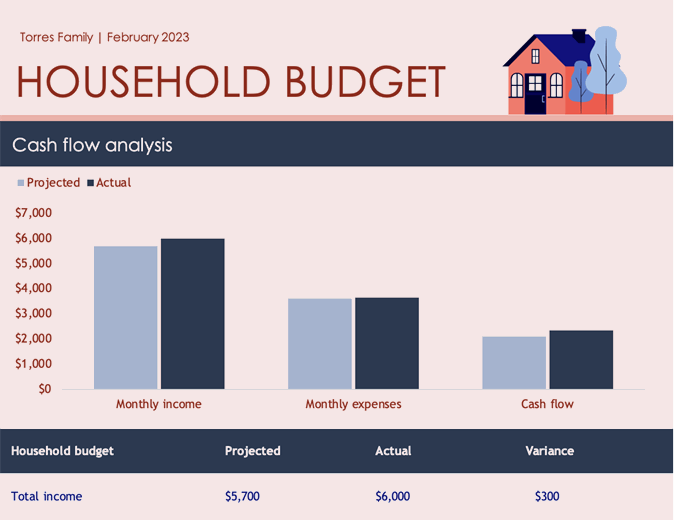

To add header information, select the top row in the Excel file and insert empty rows. The summaries allow you to see by category Budget versus Actual to see what difference exist at that level. Add a header to budget plan document template. The details are summarized by Category, Description and Date. Summaries are generated from the income and expense budget details.

If you decide you want to further define the input listed by category you may enter a descrption for each item for more detail. The budget for income and expenses can be input in as much detail on a daily basis as you desire. Use predefined categories to standardize how income and expenses should be tracked. A running total for the month allows you to manage you future expenditures based on your forecasted income and expenses, taking into account what differences have impacted your forecast.ĭetailed income and expenses are input on separate pages. The budgeted and actual income and expenses are evaluated and the difference between the two is dispayed in a weekly summary.

Note: Money in Excel is a premium template available. Track finances and get personalized tips without ever leaving Excel. It's the only template that securely connects to your financial institutions to import and sync accounts into an Excel spreadsheet. It offers a unique interface which allows you to see your cash status summarized on a monthly calendar with the variance show for each day. Money in Excel can help you take control of your finances. The purpose of this tool is to allow the user to track expected income and expenses (Budget) against what actually happens (Actuals). The Budget Tool allows you manage your budgeted and actual income versus your budgeted and actual expenditures.

0 kommentar(er)

0 kommentar(er)